Let’s be real—when you hear the word budget, your mind might conjure up images of spreadsheets, penny-pinching, and saying goodbye to all the fun stuff. But what if I told you that creating a budget could actually be an entertaining and empowering experience? Think of it as a game where you’re the hero, and your mission is to conquer your finances while still living your best life. Ready to play? Let’s dive in!

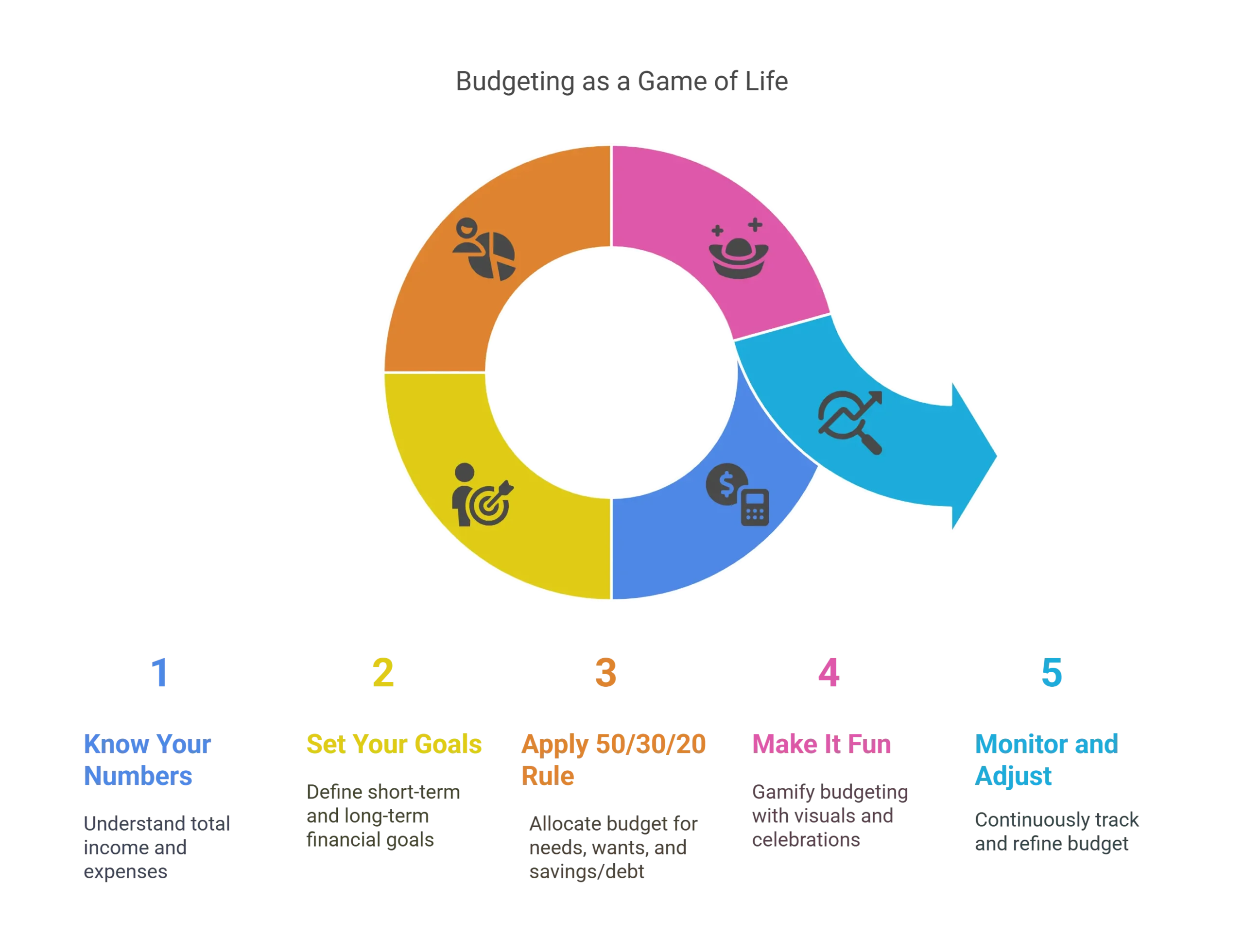

Budgeting: The Ultimate Game of Life (With Fun and Wins!)

Step 1: Know Your Numbers (The Setup)

Every great game starts with preparation, and budgeting is no different. First, gather your “stats”:

- Total Income: Add up everything — your salary, side-hustles, rental income, or even that $10 your grandma sends on your birthday.

- Expenses: Break them into two categories:

- Fixed Expenses: Rent, utilities, insurance — these are the non-negotiables.

- Variable Expenses: Groceries, entertainment, dining out — these are where the fun (and flexibility) happens.

Now subtract your expenses from your income. If you’re in the green, congrats! You’ve got a surplus to play with. If not, don’t worry — you’re about to level up.

Step 2: Set Your Goals (Your Game Plan)

What’s the endgame? Are you saving for a dream vacation? Paying off debt? Building an emergency fund? Setting short-term and long-term goals keeps the game exciting and gives you something to look forward to.

- Short-Term Goals: Think of these as side quests—paying off a credit card or saving for a concert ticket.

- Long-Term Goals: These are the epic boss battles—buying a house or retiring early.

Step 3: The 50/30/20 Rule (Your Cheat Code)

Enter one of the most popular budgeting strategies: the 50/30/20 rule. Here’s how it works:

- 50% for Needs: Housing, groceries, transportation — your essentials.

- 30% for Wants: Netflix binges, dining out, hobbies — this is where the fun lives.

- 20% for Savings/Debt Repayment: Future-you will thank you for this.

Feel free to tweak these percentages based on your lifestyle. After all, it’s your game.

Step 4: Make It Fun (Add Power-Ups!)

Who says budgeting has to be boring? Inject some fun into the process:

- Gamify It: Turn budgeting into a board game or challenge yourself to save more each month than the last. Reward yourself when you hit milestones!

- Use Visuals: Create a colorful chart or use apps with fun graphics to track progress. Watching your savings grow can feel like leveling up.

- Celebrate Wins: Paid off a bill? Treat yourself (within reason). Small victories keep you motivated.

Step 5: Monitor and Adjust (Stay in the Game)

Think of your budget as a living document—it evolves with you. Review it monthly to ensure you’re staying on track. Did an unexpected expense pop up? Adjust accordingly without guilt — it’s all part of the strategy.

Budget-Friendly Fun (Because Life’s Too Short for All Work and No Play)

Being on a budget doesn’t mean giving up on fun. Here are some creative ways to enjoy life without breaking the bank:

- Host potluck dinners with friends instead of dining out.

- Take advantage of free community events like outdoor concerts or art shows.

- Use apps like Groupon for discounts on activities and dining.

- Plan movie nights at home with popcorn and cozy blankets.

- Explore nature—hiking trails are free and often breathtaking!

The Final Boss: Financial Freedom

As you stick to your budget, you’ll start to notice something amazing—less stress about money and more control over your life. Each month brings you closer to slaying that final boss: financial freedom.

Remember, budgeting isn’t about deprivation; it’s about making intentional choices that align with your goals and values. So, grab your calculator (or app), channel your inner strategist, and start playing the most rewarding game of all—the game of financial success! 🎮💰